Will Your Insurance Pay for Your Prescription Drugs? Here's How to Find Out

By Jeemin KwonJimmy McDermott

.png) By Jeemin Kwon and Jimmy McDermott

By Jeemin Kwon and Jimmy McDermott

Using your insurance company’s website, mobile app, or direct phone number can help you price a drug based on your current insurance plan coverage benefits

Editor's note: This article was updated on March 16, 2020.

Leer este artículo en español.

There are many reasons why you would want to find out if a health insurance plan covers a certain prescription. Perhaps you’re shopping around for a new plan and it’s important that your current medications are covered. Maybe your healthcare professional just prescribed a new medication and you want to check before you get it filled at the pharmacy. While this information is searchable, it takes a little know-how to easily find it. This article can help.

Note: the information in this article is specific to health insurance plans in the US

I want to know if my current insurance covers a medication

One way to find out your prescription coverage is to call the number on the back of your insurance card. This option may be the best source of information, as sometimes employers may have different coverage than what is published online. When calling, make sure you have the following information on hand:

- Insurance member ID: this can be found on your insurance card (see a sample Medicare ID card)

- Name of the medication and the prescribed dosage

When prompted, provide your insurance member ID. Once the call representative has your account information, ask about the coverage benefits for the medication in question.

If you’re already at the pharmacy, you can also ask the pharmacist whether the prescription you’re picking up is covered by your insurance.

Additionally, most insurance companies also have portals and mobile apps that help you price a drug based on your current insurance plan coverage benefits. If you don’t already have access to an online portal, you can make an account. Below are links to the registration pages for the main health insurers in the US:

You may use mobile apps to find out your current insurance plan coverage benefits. Here are links to several mobile apps where you can find this information:

- Aetna: Aetna Mobile

- Anthem: Anthem Anywhere

- Cigna: myCigna

- Humana: MyHumana

- United Healthcare: Health4Me

As an example, here is what the process looks like on the Aetna mobile app – quick and easy!

.png)

.png)

.png)

.png)

.png)

What can I do if my insurance doesn’t cover the medication I need?

Prior authorizations:

Sometimes, insurance plans will not cover a medication without something called a prior authorization.

A prior authorization makes sure certain prescription drugs are used correctly and only when medically necessary. This means before your plan will cover a particular drug, you must show that you meet specific criteria for that drug. Prior authorizations are handled by your healthcare professional’s office; learn more about prior authorizations here. If your medication is in this category, getting a prior authorization will result in coverage.

Requesting exceptions:

If you or your prescriber believes none of the drugs covered by your insurance plan will work for your condition, you can ask your insurance to make an exception. An exception is not an appeal – learn more about filing insurance appeals here! Learn about Medicare appeals here.

If you would like to submit an exception request, locate the exception process for your plan. This is typically available on your insurance plan’s website (though sometimes your formulary document will have that info), or you can call your plan’s member services phone number (found on your insurance card). Make sure you understand:

-

Does an exception request require a form? Yes. Each insurance plan has their own form. In some cases, the insurance company will allow the healthcare professional to call or submit a letter for you.

-

What’s the expected timeline? Each plan has rules about how long it takes to review an exception request.

-

Work with your healthcare professional or the individual at your provider’s office who is responsible for developing and submitting exceptions.

If an exception request is denied, you can move into an appeal. For a detailed overview of the appeals process, click here.

I want to know if a health insurance plan I’m considering covers a medication

To get to the bottom of this question, you’ll need to understand the following terms:

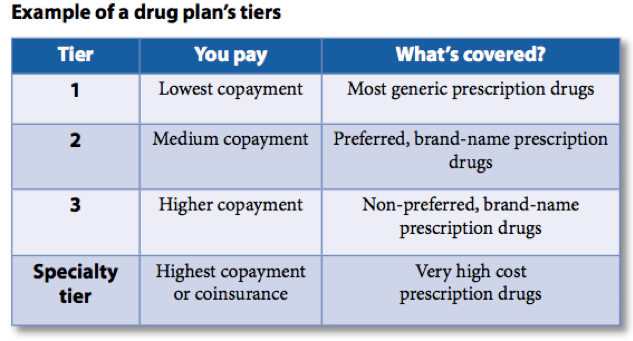

Formulary: Each health insurance plan has a list called a formulary. It describes what kind of coverage the plan provides for all prescription medications. Different levels of coverage are called tiers. Typically, lower tier numbers mean better coverage (lower out-of-pocket costs) than higher tier numbers – e.g., a Tier 1 medication has a lower out-of-pocket price than a Tier 3 medication. See here for an example of a drug formulary. For current plan members, formularies can be requested via phone or found online in the member portal.

If you are not a current member of a health plan, this info can be difficult to find, since each plan can have difference coverage rules. If you are looking at healthcare.gov plans, you may have to call the plan directly and tell them which specific plan you are considering. If you are considering a self-insured plan (a plan in which the employer takes responsibility for paying for health care for its employees), you may have to talk to your human resources department to get this information.

Summary of Benefits and Coverage (SBC): This document is a summary of what the health plan covers. While the formulary doesn’t actually tell you how much different tiered drugs will cost you, the SBC will outline how much your copay is for each tier. See here for an example of an SBC.

When you’re shopping for healthcare plans – or determining whether or not to stay with your current one – use the formulary and SBC to find out whether a specific medication is covered. For instance, in this example formulary, the Lantus SoloStar insulin pen is in tier 3. Based on this example SBC, this would be considered a “non-preferred brand”, meaning that you have to pay 40% of the drug’s cost. When choosing a health plan option, it is important to look at the lowest premium (the amount you pay for health insurance every month) and also consider which plan has the best coverage and possibly lowest out-of-pocket expenses for your medical needs.

diaTribe tip: If looking at a formulary on your computer, use the keyboard shortcut command+F (Mac) or ctrl+F (Windows) to quickly search and find the medication you’re looking for.

diaTribe tip: If looking at a formulary on your computer, use the keyboard shortcut command+F (Mac) or ctrl+F (Windows) to quickly search and find the medication you’re looking for.

During open enrollment periods (the time people are shopping for new plans, typically beginning in November), insurance companies are required to make formularies and SBCs available. It is your right to request a formulary for a plan you’re shopping for.

For current health insurance plan members, digital copies of the plan’s formulary can be found in the online portal. Print copies can also be requested by phone call.

Let diaTribe know what’s worked for you, and we’ll update this page with more advice when we hear back!

.png) This article is part of a series on access that was made possible by support from Lilly Diabetes and AstraZeneca. The diaTribe Foundation retains strict editorial independence for all content.

This article is part of a series on access that was made possible by support from Lilly Diabetes and AstraZeneca. The diaTribe Foundation retains strict editorial independence for all content.