Making Sense of Buying Health Insurance On HealthCare.gov

By Helen Gao

By Helen Gao

Twitter summary: How to visit www.healthcare.gov to buy health insurance from now until January 31, 2016 + defining all the confusing terms!

The 2016 Affordable Care Act (ACA) enrollment period began November 1 and will extend through January 31. During this time, individuals and families can shop for health insurance plans through a marketplace on www.HealthCare.gov. This process is daunting, so we’ve created an overview of what you need to know as you choose a health plan – from what’s covered to what sorts of questions you might ask.

What and when is the open enrollment period?

Under the Affordable Care Act (or the ACA, known as “Obamacare”), there is a set period of a few months – the “open enrollment period” – during which individuals and families can sign up for health insurance on the www.healthcare.gov marketplace. People can choose from a variety of health plan options offered by companies such as UnitedHealthcare, Aetna, and Blue Cross, Blue Shield.

This year, the open enrollment period began on November 1, 2015, and extends until January 31, 2016.

If you don’t have health coverage, you will have to pay a penalty when you file your taxes for the year. For 2016, the fee is either (a) 2.5% of your household income or (b) $695 for each adult and $347.50 for each child under 18 in your household, whichever is higher (with maximum limits for each). Get covered to avoid this fee (and to help pay for your healthcare expenses)!

Need help? Find a FREE Healthcare Navigator

Free, in-person help is available through a national network of “navigators” who will walk you through the enrollment process and help you pick a plan that is most appropriate for you and your family. Navigators are often available over the phone as well. You can search for a local navigator here: https://localhelp.healthcare.gov.

HealthCare.gov also includes a variety of FAQ pages that can help answer specific questions.

Don’t have time to see someone in person? No problem – Stride has made a mobile app that will recommend health insurance plans for you. It will even take into account your doctors and your prescriptions to make sure your new plan will continue to cover them.

Before you begin, what are some key questions to consider?

Check that your current doctor(s) are in the health plan’s “network” – that is, make sure the plan will cover visits to your doctor!

You can do this by clicking the “Provider directory” link on the detailed information page for each health plan that you are considering. You may have to pay more to see a doctor that is not in the health plan’s network.

Check that your medications, devices, and supplies are covered by the health plan you’re considering.

You can do this by clicking the “List of covered drugs” link on the detailed information page for each health plan. Often, different plans will cover a device or drug in the same category (e.g., blood glucose monitor and strips), but a different brand/model (e.g., LifeScan OneTouch instead of Abbott FreeStyle). You can also call the health insurance company that administers the plan in question.

Find out what coverage is offered for diabetes education, vision care, foot care, or other services.

You can call the health insurance company to gather this information. Coverage of vision care for children up through 18 years of age is mandated by law.

Who can shop for a health insurance plan during open enrollment?

Anyone who is a US citizen or resident alien can shop for health coverage on the marketplace. People with pre-existing health conditions – such as diabetes – cannot be charged a higher price just because they have an existing disease.

People who don’t have health insurance through a job or family member should especially shop for a plan on the marketplace. Some cases when this applies: if you recently turned 27 and can no longer stay on your parents’ insurance, if you recently lost your job and are no longer covered by your employer’s health insurance, or if your employer does not offer health insurance.

Should I shop for health plans if I already enrolled through HealthCare.gov last year?

Yes. Sometimes, your current health insurance plan will automatically re-enroll you for 2016, but that doesn’t always happen so you should check with your individual plan. Even if you are automatically re-enrolled, sometimes your health plan rate or the out-of-pocket expenses associated with your plan will go up drastically. It’s always a good idea to shop around on the marketplace, compare plans, and make sure you find the best-fit plan for you.

How do I sign up for health insurance during the open enrollment period?

To sign up for health coverage, start by visiting HealthCare.gov. The website will direct you to select the state you live in. Some states have their own, independent state health insurance marketplaces. If you live in one of those states, HealthCare.gov will direct you to your state’s marketplace website. If not, you can sign up for health insurance directly through HealthCare.gov. You will need to create an account with a username and password; only one account is needed for you and your whole family.

Useful information to have on hand when signing up for health coverage:

-

Address and demographic information for everyone applying for coverage

-

Social Security Numbers (SSN) for you and any family members seeking coverage

-

Immigration documents (if applicable)

-

Employer and income information (such as paystubs or W-2 forms)

-

Tax information

-

Your best estimate of your household income for 2016

-

Policy numbers for any current health insurance plans

-

Notices from your current plan that include your plan ID if you have or had insurance in 2015

How do I apply for Medicaid?

If you meet certain income requirements, you may be eligible for Medicaid, a government-sponsored health plan with low co-pays and other out-of-pocket expenses. If you are eligible, HealthCare.gov will let you know and send your application to your state’s Medicaid agency.

How do I know what out-of-pocket costs will look like for different plans?

Every health plan on the marketplace has a “Summary of Benefits” document on the detailed information page for the plan. The common terms to know in these summary documents include:

-

Premium: Every month, you will need to pay a monthly premium – this is comparable to a “subscription fee” to maintain your health insurance, regardless of whether or not you use it that month.

-

Deductible: The deductible is the amount you will have to pay for any healthcare services before the insurance kicks in to pick up the tab. This amount can range from zero to thousands of dollars. Lower deductibles mean your insurance will start paying for your healthcare sooner.

-

Co-pay: A co-pay is a fee that you have to pay for certain services ($30, for example), while the insurance pays the rest of the cost for the service. A co-pay will apply for services after you have hit the deductible amount. For instance, if you have a prescription for a diabetes medication, you might have to pay $50 every time you pick it up. Lower co-pays mean you pay less.

-

Coinsurance: A coinsurance refers to a percentage of the cost of services that you are responsible for (20%, for example). Like co-pays, coinsurance applies for healthcare costs incurred past the deductible amount. After reaching the deductible amount, if you have a pump or CGM, for instance, and your co-insurance is 20%, you would pay 20% of the total price of supplies each time you get them.

-

Out-of-pocket limit: Many plans have an out-of-pocket limit that is the maximum you will have to pay for healthcare services in a year. The health plan will cover all healthcare costs beyond this limit, and there is no limit to how much the health plan will cover.

What are the different types of health plans?

An HMO (Health Maintenance Organization) typically has lower monthly premiums and lower out-of-pocket costs than other types of health plans. HMOs have a “network” of doctors, hospitals, and other healthcare providers that you’ll have to stick to in order for healthcare services to be covered by the plan – that is the tradeoff for lower out-of-pocket expenses. You will also need a referral from your primary care physician to see specialist physicians. If you go to an out-of-network doctor, the HMO will likely not cover the cost. The exception is emergency services – you will never pay more for emergency care out-of-network than you would in-network.

A POS (Point of Service) plan generally has higher premiums and out-of-pocket costs than an HMO but offers more flexibility in the healthcare providers you can see. With a POS, you will pay less if you use in-network doctors, hospitals, and other healthcare providers, but you can still use out-of-network doctors if you wish. Like HMOs, you will need a referral from your primary care physician in order to see a specialist.

A PPO (Preferred Provider Organization) offers the most flexibility in the healthcare you can seek, but typically has higher premiums and out-of-pocket costs. You can visit any doctor without a referral from a primary care physician. You’re also able to see both in-network and out-of-network providers, but you’ll likely have higher out-of-pocket costs for out-of-network services.

An EPO (Exclusive Provider Organization) offers lower premiums and out-of-pocket costs as well as direct access to specialists without a referral. However, the network of providers for an EPO is typically much more limited, and there are strict restrictions against using an out-of-network provider.

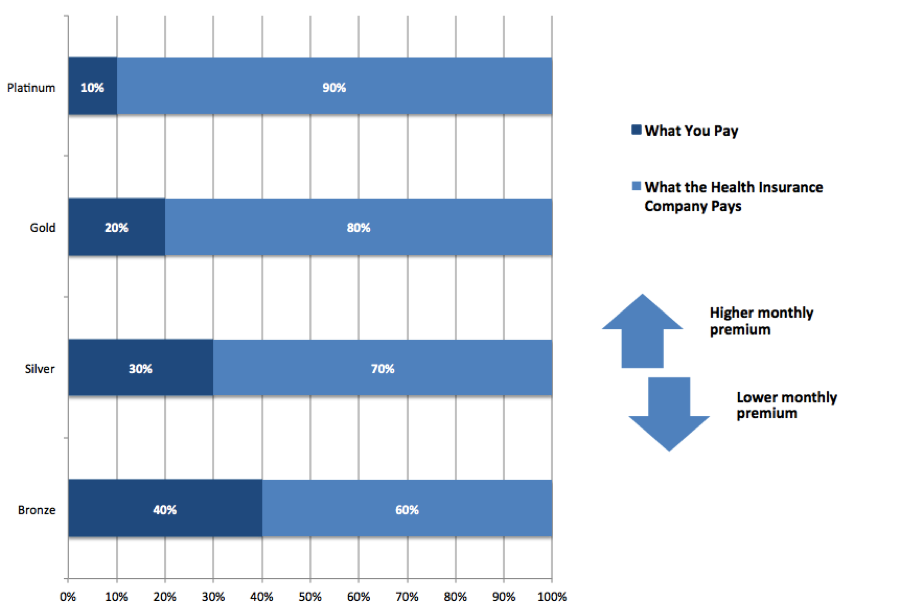

What do the different “metal levels” of plans mean?

There are four levels of plans offered on the marketplace, identified by four “metal levels”: Platinum, Gold, Silver, and Bronze. Platinum plans have the highest monthly premiums, but your personal costs for any medications and healthcare services are lowest. Bronze plans have the lowest monthly premiums, with the trade-off being much higher personal costs for medications and healthcare services.

There are four levels of plans offered on the marketplace, identified by four “metal levels”: Platinum, Gold, Silver, and Bronze. Platinum plans have the highest monthly premiums, but your personal costs for any medications and healthcare services are lowest. Bronze plans have the lowest monthly premiums, with the trade-off being much higher personal costs for medications and healthcare services.

What sort of financial help is offered?

You may be eligible for tax credits to help pay for your new health insurance premiums or other cost-sharing financial help. The amount of financial help available is determined by your income. HealthCare.gov or your state’s health insurance marketplace will collect income information from you when you apply for health insurance and calculate what financial help you’re eligible for.

What is covered by the health insurance plans that are offered?

All health insurance plans must cover the “ten essential health benefits.” These benefits are:

-

Preventive and wellness services and chronic disease management

-

Many preventive services are free, including diabetes screenings for adults with high blood pressure and pregnant women, cholesterol screenings, obesity screenings and counseling

-

Most plans will cover some form of diabetes education – be sure to check individual plans before enrolling

-

-

Outpatient services, or any healthcare services that don’t require an overnight hospital stay

-

Emergency services

-

Hospitalization

-

Laboratory services

-

Prescription drugs

-

Maternity and newborn care

-

Mental health and substance use disorder services

-

Rehabilitative services and devices

-

Pediatric care, including vision and dental

About the author: Helen Gao was a Policy Fellow at Get Covered Illinois, the Illinois health insurance marketplace during the last enrollment cycle, where she learned the ins and outs of the marketplace and health coverage. She also volunteered for several ACA enrollment fairs and provided one-on-one enrollment assistance to numerous individuals and families. For questions, she can be reached at helen.gao@closeconcerns.com.